Lesezeit

Sun 22nd Dec, 2024

The Russian economy faces significant challenges as it approaches the new year. Despite efforts by President Vladimir Putin to tackle high inflation, the situation appears to be worsening, particularly in sectors crucial to the country’s financial stability. Recent warnings indicate a potential wave of insolvencies, particularly in industries vital to Russia’s economic framework and its ongoing conflict in Ukraine.

Currently, inflation in Russia stands at a concerning 9.3 percent, a figure highlighted by Putin during a recent press conference where he described it as an alarming signal. Compounding this issue is the depreciation of the ruble, which has further exacerbated inflationary pressures. In response, the Central Bank of Russia has implemented a series of interest rate hikes, which have now brought the benchmark rate to 21 percent. This strategy aims to curb consumer and business borrowing, thereby reducing demand and alleviating inflationary stress.

Analysts predict that the Central Bank may announce additional rate increases before the end of 2024, although it has opted to maintain the current rate for now. Nevertheless, the high-interest environment is creating considerable financing challenges for many businesses across the country.

A report from the Russian news agency Interfax has indicated a troubling trend: payment defaults are spreading throughout the economy. Between July and September, approximately 19 percent of large and medium-sized enterprises experienced payment delays, while the rate was even higher–25 percent–for smaller businesses.

Even leading economists within Putin’s circle are expressing concern over the prevailing economic conditions. Igor Setschin, the CEO of Rosneft, criticized the Central Bank’s financial policies in a recent quarterly report, arguing that the interest rate hikes have negatively impacted both financing costs for his company and for its suppliers, leading to reduced profits.

One of the sectors under the most pressure is retail. The Russian Association of Shopping Centers has raised alarms, claiming that over 200 shopping centers are at risk of insolvency due to soaring financing costs. Reports suggest that nearly a quarter of all shopping centers in the country face closure in 2025. Furthermore, the rise of online retail platforms in Russia is intensifying competition, adding additional strain to brick-and-mortar stores.

Another critical area affected by the economic downturn is the defense industry. Payment defaults and escalating financing costs are disrupting supply chains for many defense contractors. Western sanctions have also restricted access to essential components necessary for the production of high-quality military equipment. Additionally, a shortage of skilled labor is further complicating matters.

According to data submitted by the Russian Ministry of Economic Development to parliament, the growth of the sector categorized as ‘other transport systems and equipment’ is projected to plummet from 30.2 percent in 2023 to a mere five percent in the upcoming year.

In a stark warning issued in late October, Sergei Chemezov, a close ally of Putin and head of the state-owned defense corporation Rostec, indicated that if prices continue to remain at current levels, a significant number of companies could face bankruptcy. This scenario could force Russia to limit its arms exports.

The defense industry is increasingly critical for the Russian government, which is investing heavily in military capabilities. Reports suggest that defense spending in Russia could reach its highest levels since the Cold War by 2025. However, doubts remain about the sustainability of such extensive military expenditures in the context of Russia’s broader economic challenges.

Lesezeit

Fri 20th Dec, 2024

On December 20, 1999, Portugal officially relinquished control of Macau, a former colony that had been under its governance for more than 400 years. This transition marked a significant shift in the region’s political and economic landscape, transforming Macau into a prominent gambling hub often referred to as the ‘Las Vegas of Asia.’

Unlike Hong Kong, which experienced significant political unrest following its handover to China, Macau has largely maintained political stability. The region, which is significantly smaller in both area and population compared to its neighbor, has become an appealing destination for tourists, primarily due to its extensive gaming industry.

Macau is characterized by its Cotai Strip, a bustling boulevard akin to Las Vegas, where visitors find a plethora of casinos, luxury hotels, and shopping centers. Numerous major companies have established themselves in Macau, drawing inspiration from the iconic resorts of Nevada. This strategic positioning has solidified Macau’s reputation as a leading entertainment destination in Asia.

Historically, Macau’s connection to China deepened long before the 1999 handover. The influence of Chinese culture and politics has been significant, particularly during the Cultural Revolution, which began in 1966. By the time of the handover, the governance of Macau had already shifted largely towards Chinese influence, leading to a unique political landscape that has not seen the same level of protest as Hong Kong.

In the years following the handover, Macau’s economy has thrived, especially after the liberalization of its gaming industry. The introduction of competitive gaming licenses attracted international operators, particularly from the United States, who have significantly contributed to the local economy. As a result, Macau’s GDP has seen remarkable growth, reaching approximately $70,000 per capita by 2023, which surpasses that of Hong Kong and mainland China.

Despite its economic success, the dependency on tourism and gambling raises concerns about sustainability. The local government has recognized this challenge and has been distributing a portion of its budget surplus to residents, ensuring that the population benefits from the economic boom.

Macau’s cultural identity remains complex, with nearly half of its residents originating from mainland China. This demographic composition has influenced local sentiment towards governance and the broader relationship with China. As political changes continue to unfold in the region, Macau has been praised as a model for the ‘One Country, Two Systems’ principle, illustrating a different trajectory from Hong Kong.

As the 25th anniversary of the handover approaches, the question of Macau’s future remains pertinent. While the region continues to flourish as a gambling and entertainment hub, the potential for greater integration with mainland China looms, prompting discussions about the long-term implications for its autonomous status and cultural identity.

In conclusion, Macau’s evolution from a colonial outpost to a vibrant economic center reflects broader trends in regional politics and economics. As it celebrates a quarter-century since its return to Chinese sovereignty, Macau stands as a testament to the complexities of post-colonial governance in the context of a rapidly changing global landscape.

With statutory health insurance contributions set to increase in January 2026, we look at how the proposed increases could affect your wallet – and what steps you can take to keep the financial impact to a minimum.

Legal Initiatives Intensify Around Abortion Pill Access

Allergie- & Immunologietage | Düsseldorf Congress

30 Tage Bikini Workout | Women’s Best Blog

8 Übungen gegen Cellulite | Women’s Best Blog

Cellulite loswerden? Das hilft! | Women’s Best Blog

BRUIT≤ – The Age of Ephemerality

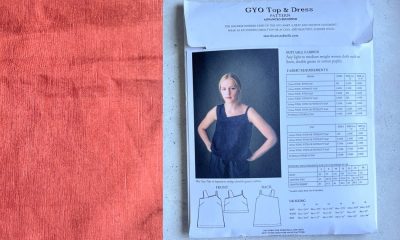

Me Made Mittwoch mit neuen Regeln am 02. Juli 2025

In diesem Blogartikel findest du eine hilfreiche ➤ CHECKLISTE mit ✔ 5 TIPPS, um deine ✔ Zeit besser einzuteilen & deine ✔ Fitness-Ziele zu erreichen! ➤ Jetzt lesen!