Lesezeit

Fri 20th Dec, 2024

The recent parliamentary investigation into the downfall of Credit Suisse has concluded that the bank itself is primarily responsible for its dramatic collapse in early 2023. This finding comes from a report detailing the bank’s significant financial losses juxtaposed against substantial executive compensation payouts over the years.

Over a span of twelve years, Credit Suisse recorded losses totaling 33.7 billion Swiss francs, while simultaneously paying out nearly 39.8 billion francs in performance bonuses to its management. Although the investigation did not directly focus on the actions of the bank’s leadership, it aimed to ascertain whether regulatory bodies had failed in their oversight responsibilities.

According to Isabelle Chassot, the chair of the investigative committee, while there was no direct misconduct identified among the regulatory agencies, the oversight provided by the Swiss Financial Market Supervisory Authority (Finma) was deemed ineffective. The committee highlighted that Finma did not assertively enforce regulatory requirements and even granted the bank leniency in its capital requirements. Furthermore, the report indicated that communication between regulatory bodies was inadequate, suggesting the need for improved collaboration among institutions responsible for maintaining financial stability.

The investigation underscores the necessity for more robust regulations governing systemically important banks and clearer guidelines to improve inter-agency cooperation. The findings are particularly significant given the backdrop of heightened anxiety in the financial markets during March 2023, when the prospect of a global banking crisis loomed large.

In March of that year, the beleaguered Credit Suisse was compelled to enter a forced sale to UBS, facilitated by government intervention and state support. This sale was precipitated by fears of a broader financial crisis, especially following the collapse of three smaller regional banks in the United States.

The committee noted that while the immediate threat of a global financial crisis had been mitigated, the circumstances surrounding Credit Suisse’s failures remain concerning. In the fiscal year 2022, the bank incurred a loss of 7.3 billion Swiss francs due to speculative trading activities and significant withdrawals of customer deposits. Despite attempts to stabilize its finances through new investment from the Saudi National Bank and a substantial credit line from the Swiss National Bank, Credit Suisse was unable to reverse its downward trajectory.

The investigation highlights critical lessons for the banking sector, particularly regarding corporate governance and regulatory oversight. The findings call for a reevaluation of existing policies to ensure that similar failures do not occur in the future, thereby protecting the interests of stakeholders and the broader financial system.

In summary, the Credit Suisse debacle serves as a stark reminder of the importance of responsible management practices and the vital role of effective regulatory oversight in maintaining the integrity of the banking industry.

Lesezeit

Fri 20th Dec, 2024

On December 20, 1999, Portugal officially relinquished control of Macau, a former colony that had been under its governance for more than 400 years. This transition marked a significant shift in the region’s political and economic landscape, transforming Macau into a prominent gambling hub often referred to as the ‘Las Vegas of Asia.’

Unlike Hong Kong, which experienced significant political unrest following its handover to China, Macau has largely maintained political stability. The region, which is significantly smaller in both area and population compared to its neighbor, has become an appealing destination for tourists, primarily due to its extensive gaming industry.

Macau is characterized by its Cotai Strip, a bustling boulevard akin to Las Vegas, where visitors find a plethora of casinos, luxury hotels, and shopping centers. Numerous major companies have established themselves in Macau, drawing inspiration from the iconic resorts of Nevada. This strategic positioning has solidified Macau’s reputation as a leading entertainment destination in Asia.

Historically, Macau’s connection to China deepened long before the 1999 handover. The influence of Chinese culture and politics has been significant, particularly during the Cultural Revolution, which began in 1966. By the time of the handover, the governance of Macau had already shifted largely towards Chinese influence, leading to a unique political landscape that has not seen the same level of protest as Hong Kong.

In the years following the handover, Macau’s economy has thrived, especially after the liberalization of its gaming industry. The introduction of competitive gaming licenses attracted international operators, particularly from the United States, who have significantly contributed to the local economy. As a result, Macau’s GDP has seen remarkable growth, reaching approximately $70,000 per capita by 2023, which surpasses that of Hong Kong and mainland China.

Despite its economic success, the dependency on tourism and gambling raises concerns about sustainability. The local government has recognized this challenge and has been distributing a portion of its budget surplus to residents, ensuring that the population benefits from the economic boom.

Macau’s cultural identity remains complex, with nearly half of its residents originating from mainland China. This demographic composition has influenced local sentiment towards governance and the broader relationship with China. As political changes continue to unfold in the region, Macau has been praised as a model for the ‘One Country, Two Systems’ principle, illustrating a different trajectory from Hong Kong.

As the 25th anniversary of the handover approaches, the question of Macau’s future remains pertinent. While the region continues to flourish as a gambling and entertainment hub, the potential for greater integration with mainland China looms, prompting discussions about the long-term implications for its autonomous status and cultural identity.

In conclusion, Macau’s evolution from a colonial outpost to a vibrant economic center reflects broader trends in regional politics and economics. As it celebrates a quarter-century since its return to Chinese sovereignty, Macau stands as a testament to the complexities of post-colonial governance in the context of a rapidly changing global landscape.

With statutory health insurance contributions set to increase in January 2026, we look at how the proposed increases could affect your wallet – and what steps you can take to keep the financial impact to a minimum.

Legal Initiatives Intensify Around Abortion Pill Access

Allergie- & Immunologietage | Düsseldorf Congress

30 Tage Bikini Workout | Women’s Best Blog

8 Übungen gegen Cellulite | Women’s Best Blog

Cellulite loswerden? Das hilft! | Women’s Best Blog

BRUIT≤ – The Age of Ephemerality

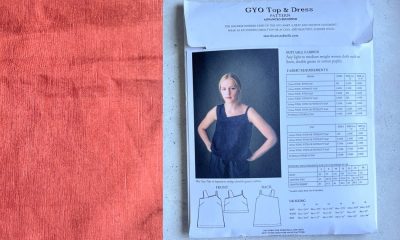

Me Made Mittwoch mit neuen Regeln am 02. Juli 2025

In diesem Blogartikel findest du eine hilfreiche ➤ CHECKLISTE mit ✔ 5 TIPPS, um deine ✔ Zeit besser einzuteilen & deine ✔ Fitness-Ziele zu erreichen! ➤ Jetzt lesen!